Global Semiconductor Shortage

The Largest Cluster of Semiconductor Production in Europe

The new Bosch plant is the latest addition to the microelectronics cluster in Saxony. The Silicon Saxony association leads a network of more than 360 companies, research institutions, universities and colleges as well as other stakeholders including start-ups operating in Europe's largest location in the globally networked semiconductor value chain. Photo: Bosch

Semiconductor Shortage in Automotive Industry Expected to Continue Well into 2022

Numerous semiconductors are installed in automotive production. If one source of components is resecured, specialized semiconductors are often missing elsewhere, which brings the entire production to a standstill.

Fluctuations in Demand in Automotive and Consumer Electronics Lead to Chip Shortage

Corona Leads to Congestion in Chip Supply

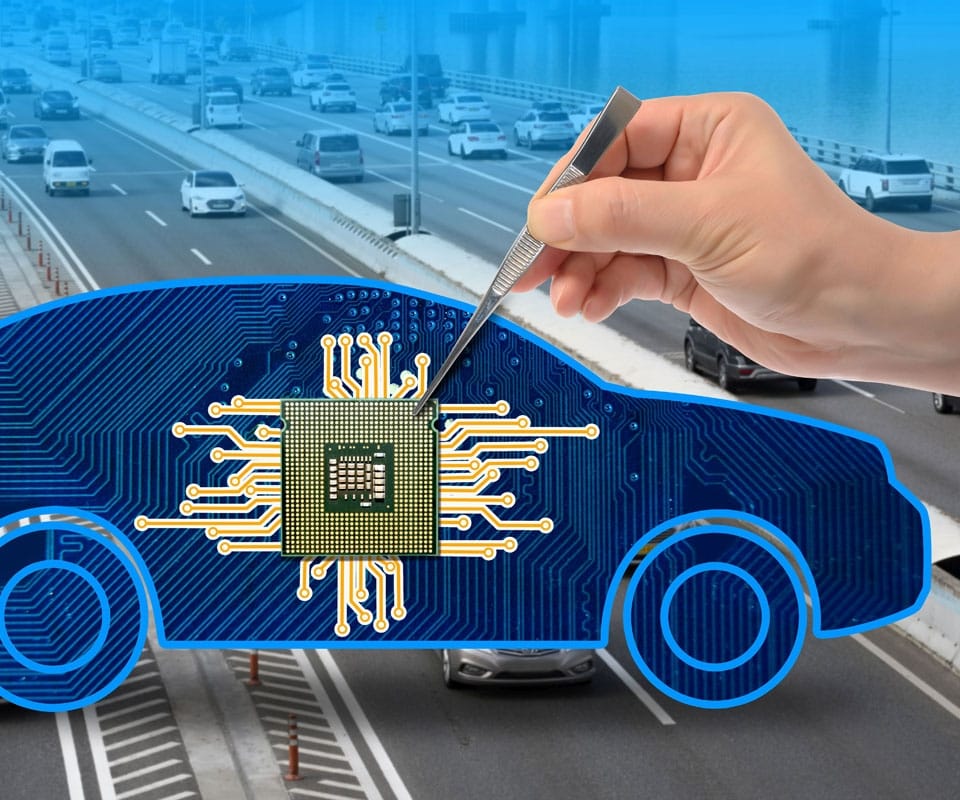

"You have to imagine the semiconductor industry like a packed, five-lane highway" says Frank Bösenberg, Managing Director of Silicon Saxony.

According to Bösenberg, there is a high, very tightly scheduled flow of traffic, where cars normally travel very fast. Disturbances in the economic situation caused by Corona have disrupted the flow of traffic. Drops in demand in the automotive industry of over 40% in some cases were passed on to the chip manufacturers, and the semiconductor highway ceased to operate at full capacity.

To make the extremely high investment costs pay off, semiconductor factories have to operate at full capacity seven days a week, 24 hours a day. A realignment took place: The semiconductor industry channeled available manufacturing capacity into other industries. Chips were primarily bought up by consumer electronics manufacturers as demand in the industry increased due to corona.

Congestion occurred when the automotive industry, in addition to the consumer electronics manufacturers, pushed back onto the semiconductor highway with increasing demand.

Production Redistribution Puts the Automotive Industry on the Hard Shoulder

Inconsistent market conditions were the result of fluctuations in demand, causing production to stagnate. These conditions are further exacerbated by the production time of semiconductors, which can take up to 6 months. A spontaneous increase in production is impossible.

Overall, it takes between three and four years from planning to the commissioning of new production capacities when a new plant is built. It takes at least one and a half years if available space in an existing factory is expanded.

The manufacture and delivery of the highly specialized machines alone, which are required for the up to 1200 individual production steps of a semiconductor, take at least nine months. Demand from the automotive industry for microchips accounts for less than 10 percent of global semiconductor sales.

Manufacturers such as Infineon produce the chips required by the automotive industry. Several hundred semiconductors are installed per vehicle, and the trend is rising. Electric vehicles require twice that amount. Photo: Infineon