Seven in Ten Enterprises Cite E-commerce Driving Need for Faster Field Operations!

Zebra Technologies Corporation (NASDAQ: ZBRA), an innovator at the edge of the enterprise with solutions and partners that enable businesses to gain a performance edge, today announced the results of its latest vision study on the Future of Field Operations.

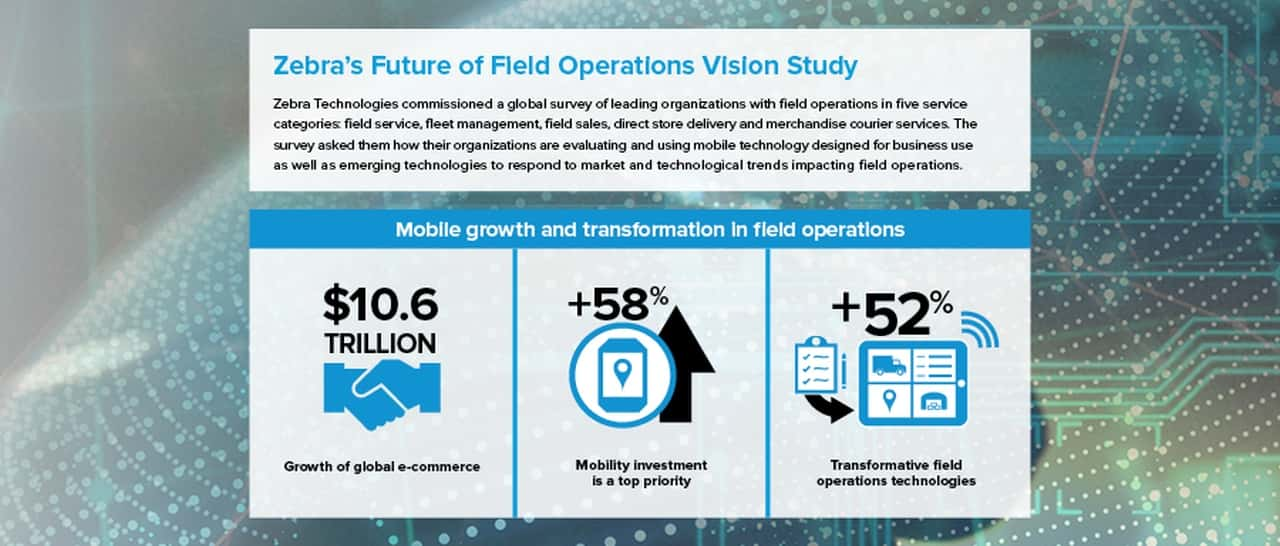

The study reveals mobile technology investment is a top priority for 36 percent of organizations and a growing priority for an additional 58 percent to keep up with rapidly evolving and increasing customer demand.

The findings indicate investments will be made in disruptive technologies and enterprise mobile devices to enhance front-line worker productivity and customer satisfaction in field operations including fleet management, field services, proof of delivery and direct store delivery workflows.

“Driven by the acceleration of e-commerce along with customer’s heightened expectations and more focus within companies on differentiating service levels, the field operations industry is rapidly adapting the way it looks at its mobile technology investments,” said Jim Hilton, Director of Vertical Marketing Strategy, Manufacturing, Transportation & Logistics, Zebra Technologies.

“Our study shows how growing challenges related to the on-demand economy drive organizations to adopt transformative, disruptive technologies such as augmented reality and intelligent labels to provide visibility and integrate business intelligence for a performance edge.”

Key survey findings

Equipping front-line workers with enterprise mobile devices remains a priority to stay competitive.

- The survey shows today only one-fifth of organizations have a majority of their field-based operations using enterprise mobile devices. This is estimated to reach 50 percent in five years.

- Respondents indicate most organizations intend to invest in handheld mobile computers, mobile printers and rugged tablets. From 2018 to 2023, handheld mobile computer usage with built-in barcode scanners is forecasted to grow by 45 percent, mobile printers by 53 percent and rugged tablets by 54 percent. The higher levels of inventory, shipment and asset accuracy provided by using these devices is expected to increase business revenues.

- A key driver of productivity, efficiency and cost-savings in field operations is ensuring ruggedized enterprise devices replace traditional consumer ones. Nearly 80 percent of respondents usually or always conduct a total cost of ownership (TCO) analysis of business devices prior to making a capital expenditure. Only 32 percent of respondents believe that consumer smartphones have better TCO than rugged devices.

Tertiary concerns and post-sale factors are important for organizations when evaluating front-line worker enterprise mobile devices.

- The survey reveals these TCO considerations when investing in new front-line enterprise technology: replacement (47 percent), initial device (44 percent), application development (44 percent) and programming/IT (40 percent).

- Almost 40 percent of respondents say device management and support costs are important as well as customer service (37 percent), device lifecycle cadence (36 percent) and repair costs (35 percent). Such factors increasingly influence the purchase cycle, showing that those who do not provide clear value or cannot control these costs will quickly be overtaken by those who do.

Emerging technologies and faster networks are disrupting field operations.

- The survey shows seven in ten organizations agree faster mobile networks will be a key driver for field operations investment to enable the use of disruptive technology.

- Significant industry game-changers will be droids and drones, with over a third of decision makers citing them as the biggest disruptors.

- The use of smart technologies such as sensors, RFID, and intelligent labels also play a role in transforming the industry. More than a quarter of respondents continue to view augmented/virtual reality (29 percent), sensors (28 percent), RFID and intelligent labels (28 percent) as well as truck loading automation (28 percent) as disruptive factors.

Key regional findings

- Asia Pacific: 44 percent of respondents consider truck loading automation will be among one of the most disruptive technologies, compared respectively to 28 percent globally.

- Europe, Middle East and Africa: 70 percent of respondents agree e-commerce is driving the need for faster field operations.

- Latin America: 83 percent agree that faster wireless networks (4G/5G) are driving greater investment in new field operations technologies, compared with 70 percent of the global sample.

- North America: 36 percent of respondents plan to implement rugged tablets in the next year.

Survey background and methodology

- The Future of Field Operations Vision study reports why mobile technology investment is a top priority for organizations, with over half planning investments to keep pace with more proactive, customer-centric, business-driven systems.

- The online survey interviewed 2,075 mobility decision makers from 20 countries across the United States, Canada, Brazil, Mexico, Colombia, Chile, Argentina, France, Germany, United Kingdom, Italy, Sweden, Netherlands, Saudi Arabia, South Africa, China, India, Japan, Australia and New Zealand.